Turning Crises Into Opportunities, The Rockefeller Way

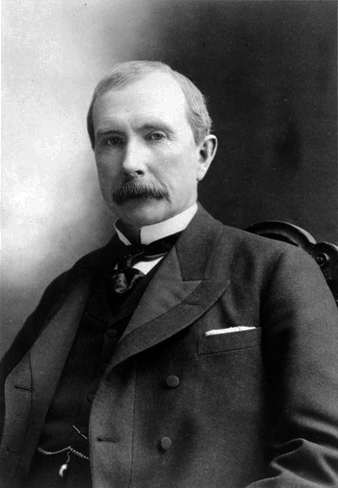

A lot of successful people owe their success to the problems they experienced along the way - such as the oil tycoon John D. Rockefeller.

John D. Rockefeller Sr. was the richest man in history. Adjusted for inflation, he was even richer than Jeff Bezos and Bill Gates are today.

To the superficial observer, the life stories of successful men and women will often appear as a steady succession of triumphs. However, this perspective frequently ignores the huge problems all high achievers have had to contend with - problems which at first sight seemed insurmountable and which might easily have caused lesser persons to stumble and fall. In fact, a lot of successful people owe their success to the problems they experienced along the way - such as the oil tycoon John D. Rockefeller, whose various business ventures established him as the richest man in history.

While working in the food trade, Rockefeller entered the energy sector as a kind of sideline. At 24, he formed an oil company to make some extra money. At the time, nobody could have guessed just how important oil was to become. Nobody knew how long the boom would last - would it prove to be as short-lived as the gold rush had been? Or would the oil industry establish itself as a profitable, long-term business? Oil prices were subject to extreme fluctuations. In 1861, a barrel was worth anything between 10 cents and $10. Three years later, in 1864, prices were still fluctuating between $4 and $12. Every time a new oil well was tapped, prices hit rock bottom - until fears that oil might soon become scarce caused them to rise sky-high again.

Speculators saw the new industry as an opportunity to get rich quickly and effortlessly. Refineries sprung up everywhere, and by 1870, they already had the capacity to process three times as much oil as was being extracted from the earth at the time. Three-quarters of all refineries were running at a loss - one of Rockefeller’s main competitors even offered him shares in his company at a tenth of their book value.

In the midst of this crisis, Rockefeller himself stood to lose his entire fortune. “As someone who tended toward optimism, ‘seeing opportunities in every disaster,’ he studied the situation exhaustively instead of bemoaning his bad luck. He saw that his individual success as a refiner was now menaced by industrywide failure and that it therefore demanded a systemic solution,” Rockefeller’s biographer Ron Chernow writes.

Rockefeller formed the Standard Oil Company as a joint-stock firm, setting himself a huge goal: “The Standard Oil Company will someday refine all the oil and make all the barrels.” His aim was to gain control over the entire oil industry. He put seed capital of $1 million into his new company, at the time an unprecedented amount of money, which he soon raised to $3.5 million. He recruited exceptionally gifted managers and started expanding aggressively - in a time of severe economic crisis. “It was a sign of Rockefeller’s exceptional self-confidence that he gathered strong executives and investors at this abysmal time, as if the depressed atmosphere only strengthened his resolve,” reports Chernow.

What Distinguishes Winners From Losers

That’s the crucial difference between winners and losers: losers allow the general mood to affect them. When others around them are depressed, they become depressed, too. Winners have a different perspective. They see opportunities where everybody else sees problems and, more importantly, they are able to focus exclusively on exploiting those opportunities. They know that economic instability is the perfect time to go shopping, to buy up other companies, shares or even human talent.

In the midst of the general economic crisis, Rockefeller was able to negotiate favourable contracts with the railroad companies, who granted him discounts for transporting his company’s oil, giving him an important advantage over his competitors. However, rumours of these deals were met with massive protests and boycotts against his company, which forced him to let go of 90% of his work force temporarily. Speculation about a secret pact between Rockefeller and the railroad companies increased the general feeling of fear and uncertainty, which in turn allowed Rockefeller to take over 22 of his 26 competitors in Cleveland in the space of a few weeks. In early March 1872, he took over six rival companies within two days. Since most other refineries were operating at a loss, he bought them up at bargain prices, frequently paying no more than scrap value for the companies’ assets.

The Stock Market Closes - And Rockefeller Controls The Entire Oil Industry

In 1873, the U.S. economy was in severe crisis. Several banks and railroad companies went bankrupt, and the stock market was forced to close down temporarily. This was only the beginning of a recession which would last six years. Who needed oil in a situation like that? The oil price fell to 48 cents – even water cost more than that in some places. Once again, Rockefeller saw the crisis as an opportunity. He continued to buy up rival companies at even lower prices, and raised capital for future takeovers by cutting dividends. He had not even hit 40 yet and already controlled the entire refinery industry. Even the railroad companies were dependent on him, because he had started investing in the construction of tank cars and would soon own the entire fleet.

But there was more trouble ahead. The Pennsylvanian oil fields had been almost exhausted and nobody knew whether more oil would ever be found anywhere else. At the same time, the largest oil reserves to date were discovered near Baku on the Caspian Sea. Yielding 280 barrels each a day, the Baku oil wells were many times more productive than the ones in America, which only yielded four to five barrels. The American share of the global refinery market—which effectively meant Standard Oil’s share, since the company controlled 90% of the U.S. market - fell dramatically.

Rockefeller responded by drastically cutting expenses and by investing large sums of money into research. When new oil wells were discovered in Lima, Ohio, which proved to be too high in sulfur, Standard Oil developed a process to extract the sulfur, thus making the Lima wells exploitable. In the early 1890s, Rockefeller’s company controlled two-thirds of the global oil market.

Rockefeller’s Business Was Broken Up - But He Triumphed Nevertheless

Rockefeller’s problems had only just begun. Soon he was confronted with accusations and lawsuits charging him with violating antitrust regulations and attempting to build a monopoly, just as Microsoft and Bill Gates would be a hundred years later. On May 5, 1911, after two decades of legal wrangling, the Supreme Court ordered the divestiture of Rockefeller’s Standard Oil Company. The business was given six months to sell its subsidiaries.

Even in the midst of this crisis, which destroyed the company he had spent 41 years building, Rockefeller did not panic. The news of the Supreme Court’s decision was brought to him while he was playing golf with a Catholic priest. “Father Lennon, have you some money?” Rockefeller asked him. The priest shook his head and inquired why Rockefeller had asked. “Buy Standard Oil,” the 72-year-old entrepreneur advised him.

As Rockefeller’s biographer explains: “Precisely because he lost the antitrust suit, Rockefeller was converted from a mere millionaire, with an estimated net worth of $300 million in 1911, into something just short of history’s first billionaire. In December 1911, he was finally able to jettison the presidency of Standard Oil, but he continued to hold on to his immense shareholdings. As the owner of about one-quarter of the shares of the old trust, Rockefeller now got a one-quarter share of the new Standard Oil of New Jersey, plus one-quarter of the 33 independent subsidiary companies created by that decision.”

Rockefeller’s life demonstrates in exemplary fashion how successful people thrive on problems. Every problem constitutes a challenge, and by solving it, they grow even stronger. Problems are tests: only when they are passed is it possible to move to the next, higher level. When confronted with a real problem, embrace it as John D. Rockefeller did and look for the opportunity that comes with it!

Dr. Rainer Zitelmann is a historian and sociologist. He is also a world-renowned author, successful businessman and real estate investor. His most recent is: Dare to be Different and Grow Rich : Secrets of self-made people who became rich and successful, released in 2019.