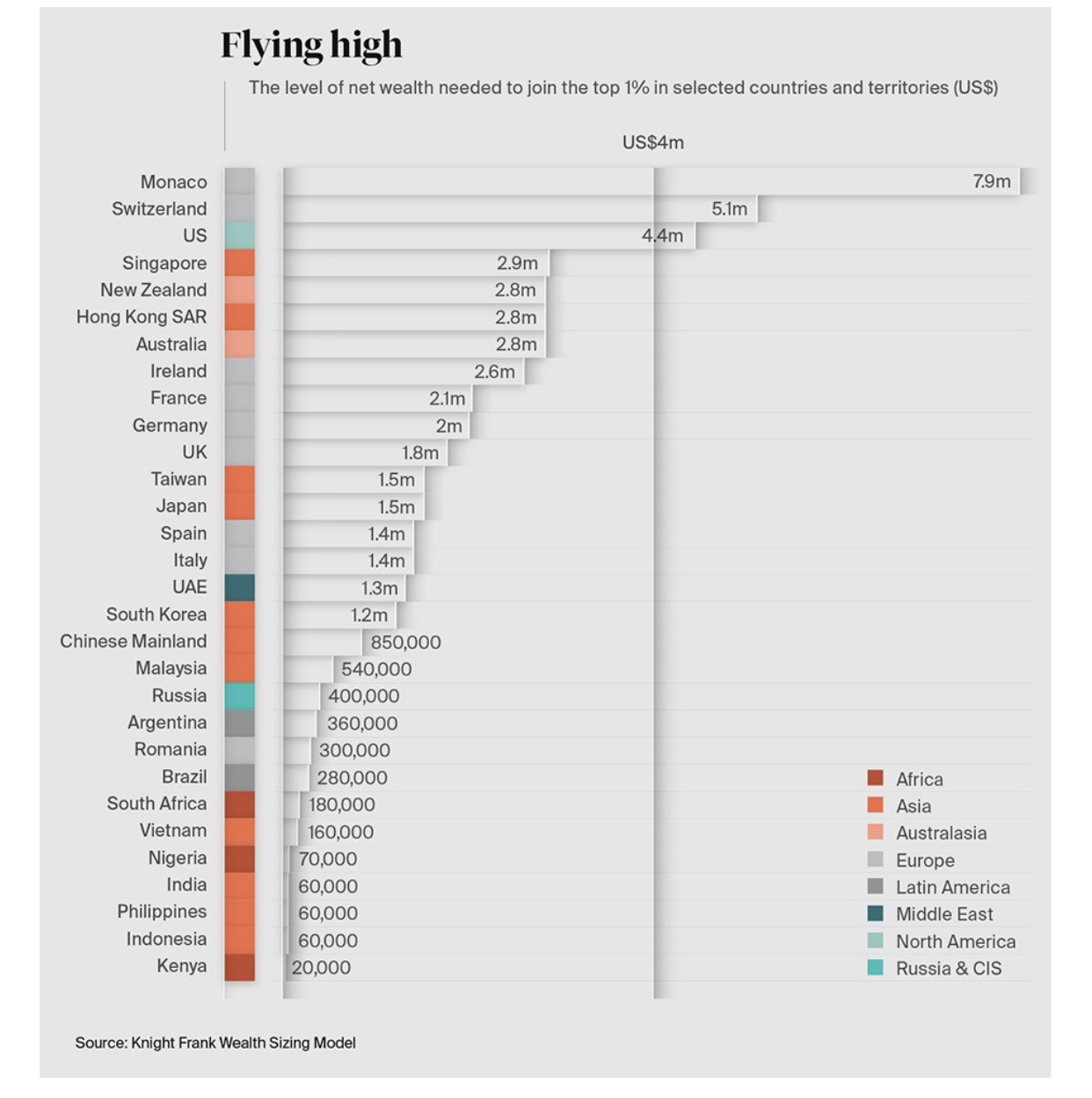

How Rich Do You Need To Be, To Make The Top 1%?

The top 1 percent is frequently cited, sometimes maligned, but at what point can you say you have made the cut?

The level of net wealth that marks the threshold for entering the rarefied community of the top 1%, varies widely among different countries and territories. For example, in Malaysia US$540,000 marks entry into the top 1% club, but if you are living in Switzerland you can consider yourself an outsider with less than US$5.1m.

According to Knight Frank's Wealth Report 2021 published this week, the threshold for being part of this exclusive club is lower than you might think. And this is not for a good reason. "Wealth inequality has become starker within countries and globally, particularly as a result of the Covid-19 pandemic, and this is likely to become a point of growing contention," said the authors of the report.

It also falls far short of an understood definition of a UHNWI – somebody whose net wealth exceeds US$30 million – even in Monaco, which has the world’s densest population of super rich. The entry point for the principality’s branch of the 1% club – the world’s most exclusive – is US$7.9 million.

In second place is Switzerland, where US$5.1 million is the threshold, followed by America, which has the highest population of UHNWI residents. In the US, US$4.4 million gains access to 1% status.

Singapore, in fourth place, is the top entry in Asia, slightly ahead of Hong Kong, with the net worth required at US$2.9 million and US$2.8 million respectively.

New Zealand has a US$2.8 million barrier – US$80,000 more than you would need in its Antipodean peer, Australia.

Argentina is the highest entry for Latin America at US$360,000, ahead of Africa’s highest – South Africa at US$180,000.

Developing markets Indonesia and Kenya have thresholds that are below 1% of the level of Monaco at US$60,000 and US$20,000 respectively. India has the same 1% level – US$60,000 – but with an ultra wealthy population 10 times that of Indonesia and 14 times that of the Philippines. Wealth growth forecasts predict India’s threshold to almost double over the next five years, though.

The Chinese Mainland is also forecast to see its 1 percent threshold rise by almost 70% from US$850,000 in 2020. This translates as rising wealth but growth is not uniform.

Overall last year was not a bad year for the UHNW, despite the ongoing pandemic. With lower interest rates and more fiscal stimulus, asset prices have surged, driving the world’s UHNWI population 2.4% higher over the past 12 months to more than 520,000, said the Knight Frank report.

The process was seen across North America and Europe, but it was Asia, with 12% growth, that saw the real upswing. The expansion in wealth was not universal, with a fall in the number of UHNWIs in Latin America, Russia and the Middle East as currency shifts and the pandemic undermined local economies.