Why The New Normal Will Be Anything But Normal

Times of intense turbulence trigger a moment of truth for companies, says a report from Bain.

The biggest shifts in company fortunes, for good or for bad, happen coming out of downturns. They are moments of truth when management teams can transform and reset their companies. Never before, though, has a downturn forced such immediate transformation, according to a new report from consultant Bain.

An asymmetrical recovery awaits us, as employees return to work and operations resume on different timetables. Different regions and different industries will restart at different times, while the value chain will be disrupted as some parts of it have become defunct. Over-ridingly, the pandemic will return again and again to test communities with new rounds of reinfection and lockdown, and many will have to start again and again.

But with a downturn, comes great opportunity. According to the report, there are 47 percent more rising stars in turbulence as there are in a stable period. There are also 89 percent more 'sinking ships' during turbulence than stability. (Bain categorises 'rising stars' as companies that moved from the bottom quartile of the S&P industry sector to the top half between between the beginning and the end of the period. Sinking ships are those that moved from the top quartile to the bottom half, including US S&P 500-listed companies with annual revenues of more than US$2 billion.)

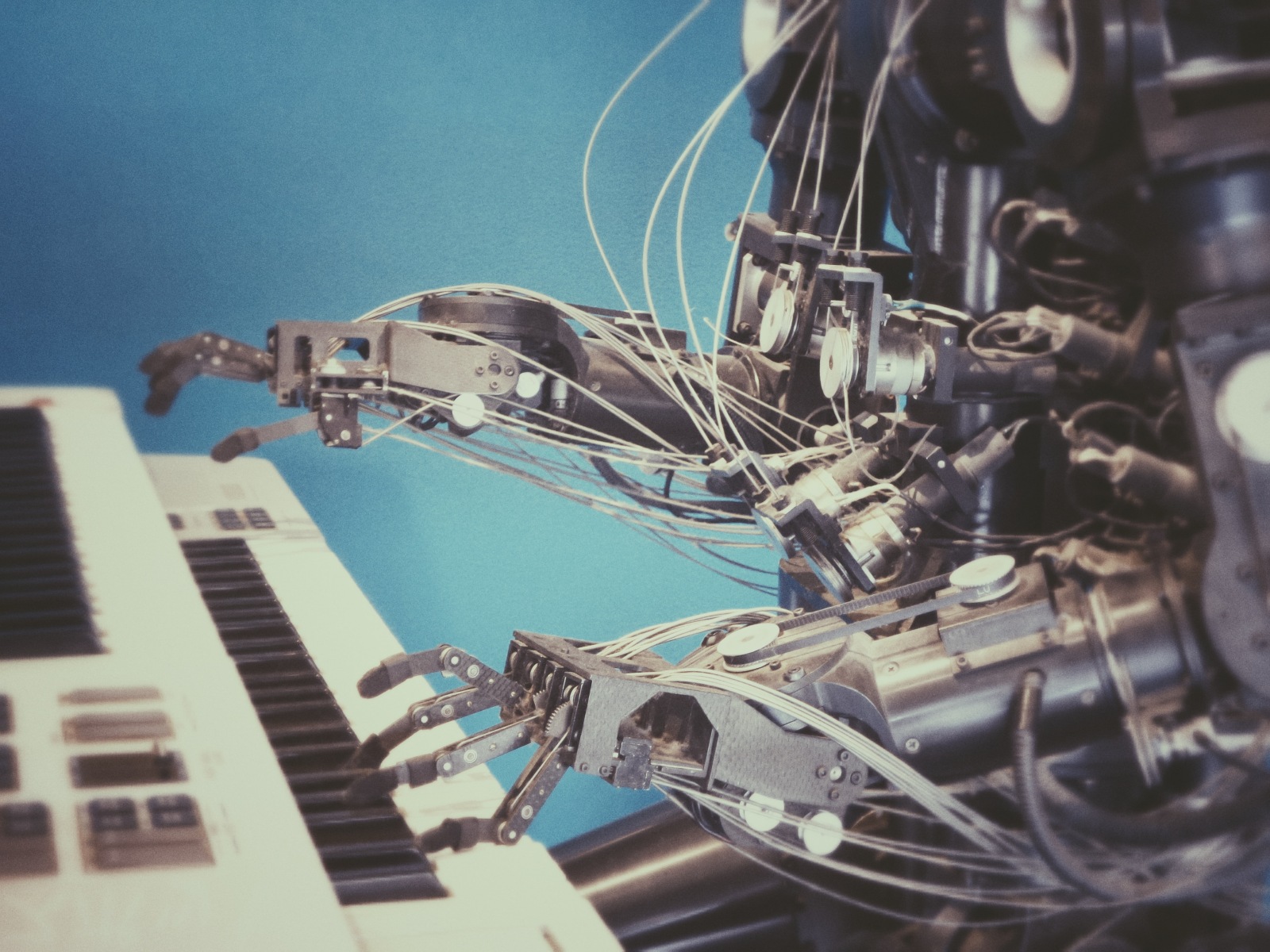

AUTOMATION

One thing Bain sees as inevitable is the rise of automation. Digital technologies and automation played a critical role in many companies’ initial response to the crisis,. But what was more remarkable than the the working from home and video-conferencing was the willingness of companies' legal, compliance and sales departments to cut through any bureaucracy in order to do so. Agility and adaptation became order of the day.

Digital roadmaps that were set out for a few years ahead were accelerated within days. Bain pointed to one global manufacturer of industrial equipment which continued to operate with virtually no interruptions during the crisis by moving the majority of its transactions online through automation. Going forward, the company plans to triple the productivity of its field salesforce by further leveraging its marketing and sales technology.

Bain research shows that more than 70 percent of B2B buyers—and a growing number of sellers— feel that virtual sales calls are as effective as in-person calls for complex products, even those involving a high degree of customization or configuration.

Another Bain survey of IT buyers shows that more than 80 percent of companies are accelerating their automation initiatives in response to Covid-19. Yet if history is any guide, fewer than half of these will achieve their automation goals.

Long-term success will depend not on automating a list of tasks, but on redesigning the work and processes with an eye toward automation and digitalization where they will provide the greatest value.

NETWORKS

As more companies become sinking ships, those that survive will take care to spread their network wider to avoid reliance on a single supplier and to have a backup. Toyota, for example, reduces risk by having one supplier produce 60 percent of the needed parts, while two additional suppliers each produces 20 percent, according to Bain.

Visibility across the supply chain has started to, and will continue to, be a key practice. 'Control tower' solutions that integrate data across the entire supply chain, along with 5G technology and blockchain, offer leadership teams real-time visibility and allow them to calibrate supply and demand during normal times, as well as react to supply and demand shocks.

But at the same time, companies will be seeking a greater simplicity. Now is the time, says Bain, for companies to look at the products that they do not need and discard them.

And, when tempting new product opportunities arise, as they will, companies need to balance the obvious revenue opportunity against the hidden cost of complexity. Many of the best companies rely on a simple rule: Do not add a new product without subtracting an old one.