The Green Premium

The technology to allow the world to achieve net zero has not yet been commercialised. But it’s a work in progress, according to Bill Gates’ Breakthrough Energy.

It’s the elephant in the room. According to the International Energy Agency, we cannot meet Paris Agreement goals to keep climate change-induced global warming well below two degrees Celsius with the technology and policies we currently have. Almost half of the emission reductions that are needed to reach net zero by 2050 will need to come from technologies that have not yet been commercialised.

The major hurdle, believes philanthropist Bill Gates, is the price of replacing our old industrial systems with clean tech, a concept he calls the ‘green premium’. He explains in his blog, Gates Notes, that the green premium is the difference in cost between doing something in a way that produces greenhouse gases and doing the same thing in a clean way.

For instance, if you fly an aircraft on traditional fuel, it costs around US$2.22 per gallon. If you power it with clean biofuels instead, the cost is around US$5.35 a gallon. The difference between these two — about 140 percent — is the green premium for jet fuel. So, if you want to cut out the emissions from flying a jet, it’ll cost 140 percent more at the moment.

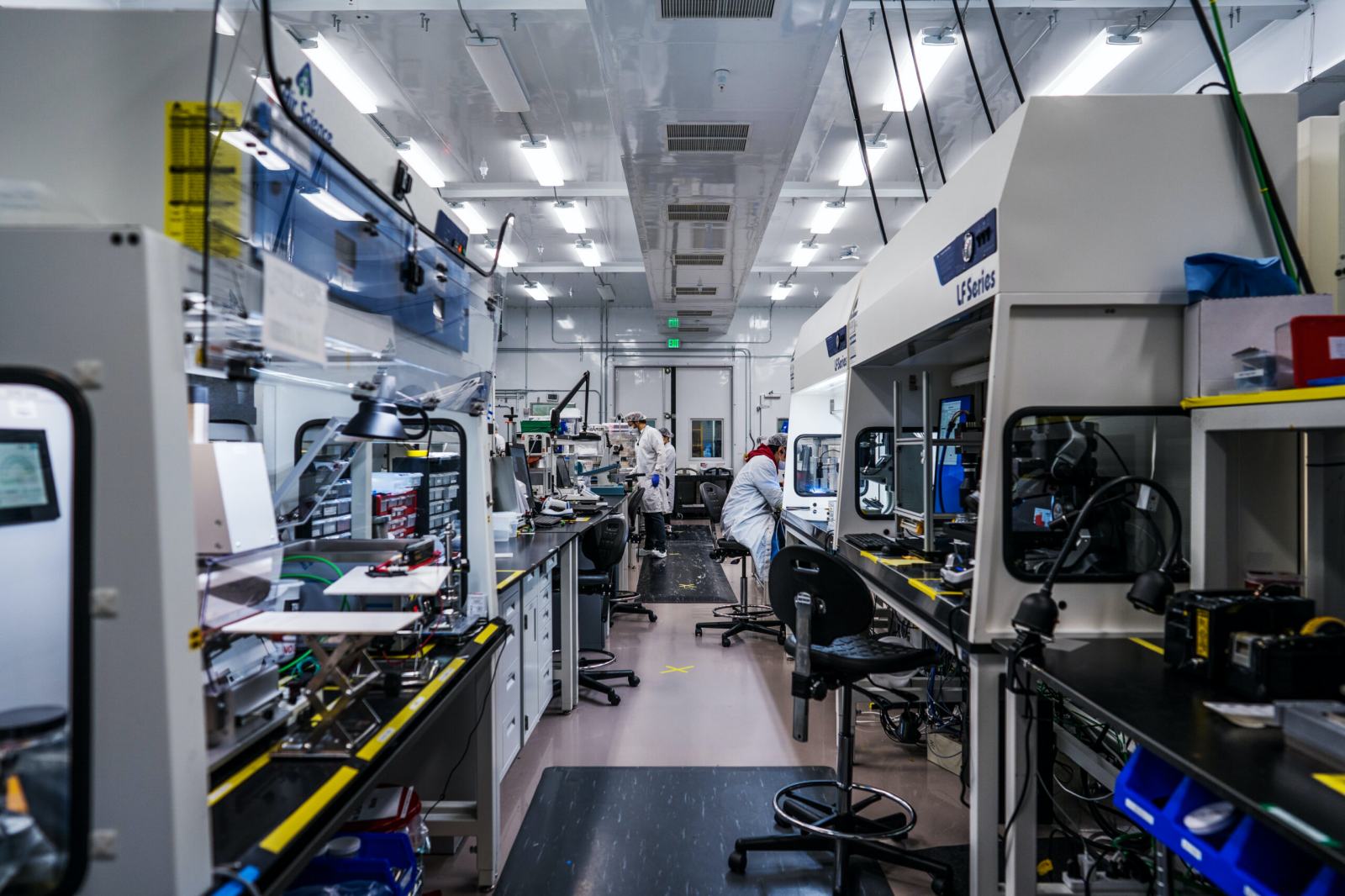

This matrix is important because it can help us to see where there are already good solutions, and where needs new technologies to bring the costs of using green alternatives down, says Ann Mettler, vice-president of Breakthrough Energy’s Europe team. Breakthrough Energy is a network of investment vehicles, philanthropic programs, and policy and advocacy work founded by Bill Gates to accelerate the clean energy transition in service of reaching net-zero emissions by 2050. It is divided into a number of parts, the US$2 billion+ venture fund (Breakthrough Energy Ventures) which has funding from Jeff Bezos, Mark Zuckerberg and Jack Ma, among other billionaire philanthropists, split into two funds investing in approximately 55 companies. In addition to venture, Breakthrough Energy has built programs all geared toward accelerating the development and deployment of climate technologies – the most ambitious of which is called Catalyst, which will bring together governments and the private sector to build commercial demonstration projects for clean technologies and lower their costs.

“What happens in 2050 is determined by what happens today,” says Mettler. “We have done the easy part with renewables, now we need to get to the technologies that are called hard-to-abate for a reason, such as steel manufacturing and cement,” says Mettler. Only when the cost to convert to clean energy is low, will corporates and governments adopt them on a wide scale, she explains.

There are some cases where the green premium is negative, for example, some cities where replacing a gas furnace with an electric heat pump will save money over the long term. There are other examples of green premiums that are very price competitive, such as the costs to turn electricity production from fossil fuels to wind, solar, hydro and nuclear.

Where the green premium is highest is where innovation in technology and policies need to happen. “Innovation in clean tech takes significantly longer than other industries; it might take 25 years, and that’s 25 years we simply don’t have. So how can we accelerate the innovation cycle?” says Mettler.

She says that most clean-tech innovations are at a time in their lifecycle after the research and development (R&D) stage, so they are being part-funded by governments but are still too risky for the private sector.

Breakthrough Energy invests primarily in businesses where the risk of failure is high and the timeframe for return on investment is 20 years. Traditional venture capitalists look for a return on investment in five years, which may not be enough for the special challenges of the energy sector. “A lot of entrepreneurs in the space find themselves between funding, such as those working on clean cement, sustainable fuels, green steel and carbon storage,” says Mettler.

She points out that it is also competing with the incumbent technology, which is very cheap, works well and, oftentimes, the environmental damage it causes is hard to see. Without policy in place to encourage take-up, clean-tech companies are facing an uphill struggle.

Breakthrough Energy focuses on both the supply and demand of innovation. On one hand it invests in promising start-ups and on the other it speeds up commercialisation of green energy by subsidising the green premium, to create more of a market for these technologies.

The start-ups it finances are ground-breaking in the five sectors which present the biggest challenges, as they are the main contributors to the 51 billion tons of greenhouse gases emitted each year. These sectors are manufacturing (31 percent); electricity (27 percent); agriculture (19 percent); transportation (16 percent); and buildings (7 percent).

Bloom Biorenewables is one such company, a multi-award-winning Swiss spin-off from the École Polytechnique Fédérale de Lausanne, created in 2019. Bloom has developed technology to convert the most abundant biopolymers on Earth, cellulose and lignin, into added-value chemical products.

Another is Redwood Materials, a Nevada e-waste recycler started by the co-founder of Tesla. ZeroAvia is developing a 2MW hydrogen-electric powertrain to power a full-size aircraft. It hopes to commercialise this by 2024. Its hydrogen solutions will initially target a 500-mile range in 10-20 seat aircraft used for commercial passenger transport, package delivery and agriculture. It is looking at a solution for a 50-plus-seat commercial aircraft segment by 2026.

Nature’s Fynd is a Chicago-based food-tech company born out of research conducted for NASA on microbes with origins in Yellowstone National Park. It has invented a fermentation technology that produces something it calls ‘Fy’, a nutritional fungi protein that only uses a fraction of the resources required by traditional agriculture.

Mettler urges large corporates to step up and start buying green steel, green cement and green fuel and clean protein, now that the green premium is lower. “Buying down a green premium cannot succeed without off-takers. For instance, we’ve seen digital technology firms have become the largest buyers of renewable energy.

“We now need car companies to step up and be the off-takers for green steel. We need airlines to be the off-takers for sustainable aviation fuels,” says Mettler.

Progress also must be addressed with urgent and radical new policies, adds Mettler. “We can’t subsidise fossil fuels and at the same time claim we are climate champions. Despite the many pledges that governments have made, it seems we are only regressing. Our laws, standards and regulations were made for the Industrial Age.”

This year, as the world comes out of Covid-lockdown and economies rebound, we are on track to hit our second-largest increase of CO2 emissions ever, according to the International Energy Agency; a call to action if ever there was one.

Breakthrough Energy is also working on influencing policy and changes are happening. Last month, the European Commission announced a partnership with Breakthrough Energy to raise an additional US$1 billion to support low carbon technologies. Breakthrough’s capital raised from private and philanthropic funds would be matched by funding provided by the EU, with the aim together to raise US$1 billion between 2022 and 2026.

Mettler, at the proverbial coal face, says she personally feels “very positive”.

“Having worked in public policy for well over 20 years, I have rarely seen so much momentum. Today, nine of the ten largest economies in the world have net-zero targets and only days ago the International Energy Agency called for an end to all new oil and gas exploration. That would have been unthinkable only two years ago. As the effects of climate change will become ever more evident and urgent, I predict that the current drive will even accelerate. In other words, striving towards a net-zero emissions future is now an irreversible trend and it’s clear that clean energy innovation and breakthrough technologies will play an instrumental role along the way.”

This article originally appeared in the Power Issue of Billionaire, Summer 2021. To subscribe contact