Millennials and Billionaires Prop Up The Art Market

A report suggests 2020 was not the disaster for artists and dealers, that many feared.

Global sales of art and antiques reached an estimated US$50.1 billion in 2020, down 22 percent on 2019, but it could have been worse, says Dr Clare McAndrew, cultural economist and author of the Art Basel and UBS Global Art Market Report.

She points to the 2009 recession when art sales sank 36 percent, but there were several differences this time. Firstly, the move to online, where sales reached record highs - doubling in value. Though the pandemic forced many auction houses, galleries and fairs to abandon in-person activity, it also accelerated digital transformation. Online sales doubled in value from 2019 to reach a record high of US$12.4 billion. The figure represented a record 25 percent share of the market’s total value - the first time the share of e-commerce in the art market has exceeded that of general retail.

Indeed, many collectors felt the pandemic increased their interest in collecting, according to the report, which surveyed more than 2,500 collectors across 10 markets.

Despite having fewer opportunities to buy in-person, collectors surveyed remained actively engaged with the art market in 2020, buying an average of nine works, versus 10 in 2019. 66 percent of those surveyed said the pandemic had increased their interest in collecting, and one third (32 percent) said this increase had been significant. Many intend to be active in 2021, with 57 percent planning to purchase more work. Foot traffic data from UBS Evidence Lab offers early indications of renewed visits to commercial galleries in 2021.

Of these, said the report, billionaires and millennial high net worth collectors were in the lead.

Next Generation

Millennial HNW collectors were the highest spenders in 2020, with 30 percent having spent over US$1 million (versus 17 percent of Boomers). This is partly because millennials were also more likely to be active online, reporting greater use of online viewing rooms offered by art fairs and galleries, and social media channels.

New York-based collectors Lisa Young and Steven Abraham are two such collectors, who only began their collector journey in 2018 with their first acquisition: Fragments (2016) by Aïda Muluneh. The Young-Abraham Collection is focused on art that explores Black Indigenous and People of Other Colour (BIPOC) something they feel a connection to as Asian Americans. According to Christophe Noe, founder of art collecting platform Larry's List, "they believe that collecting is not just about owning art but supporting the artists behind it. As such, they prioritise building relationships with artists through studio visits."

In 2020 they still bought art, including a painting entitled I Had Such an Amazing List (2019) by Natisa Jones, according to an interview on Artsy.

"With many shows being upended and everyone staying home, we found ourselves spending more time doing virtual studio visits and connecting with other collectors, curators, galleries, etc," said the couple in the interview. "A silver lining has been being able to do this with people outside of New York and taking more time for personal connection."

Billionaires keep buying

The other major reason why this global crisis affected the art market less than in 2009, was billionaire wealth, said the report. In the fallout from the global financial crisis, the number of billionaires worldwide fell by 30 percent and their wealth plummeted 45 percent. In 2020, the number of billionaires rose 7 percent and their wealth grew 32 percent over the year.

"Although not all billionaires collect art, the preservation and enhancement of wealth in this segment globally is very likely to have been one factor that stopped the art market from having a worse recession than it may have done," said Dr Clare McAndrew in the report.

And unlike previous recessions, there was also a notably heightened awareness and strong drive by some collectors to support the arts, and help ensure the survival

of businesses, artists, and museums during the crisis, said the report. Without travel and other opportunities for luxury outlays, some collectors also had more time and budgets to browse and buy art.

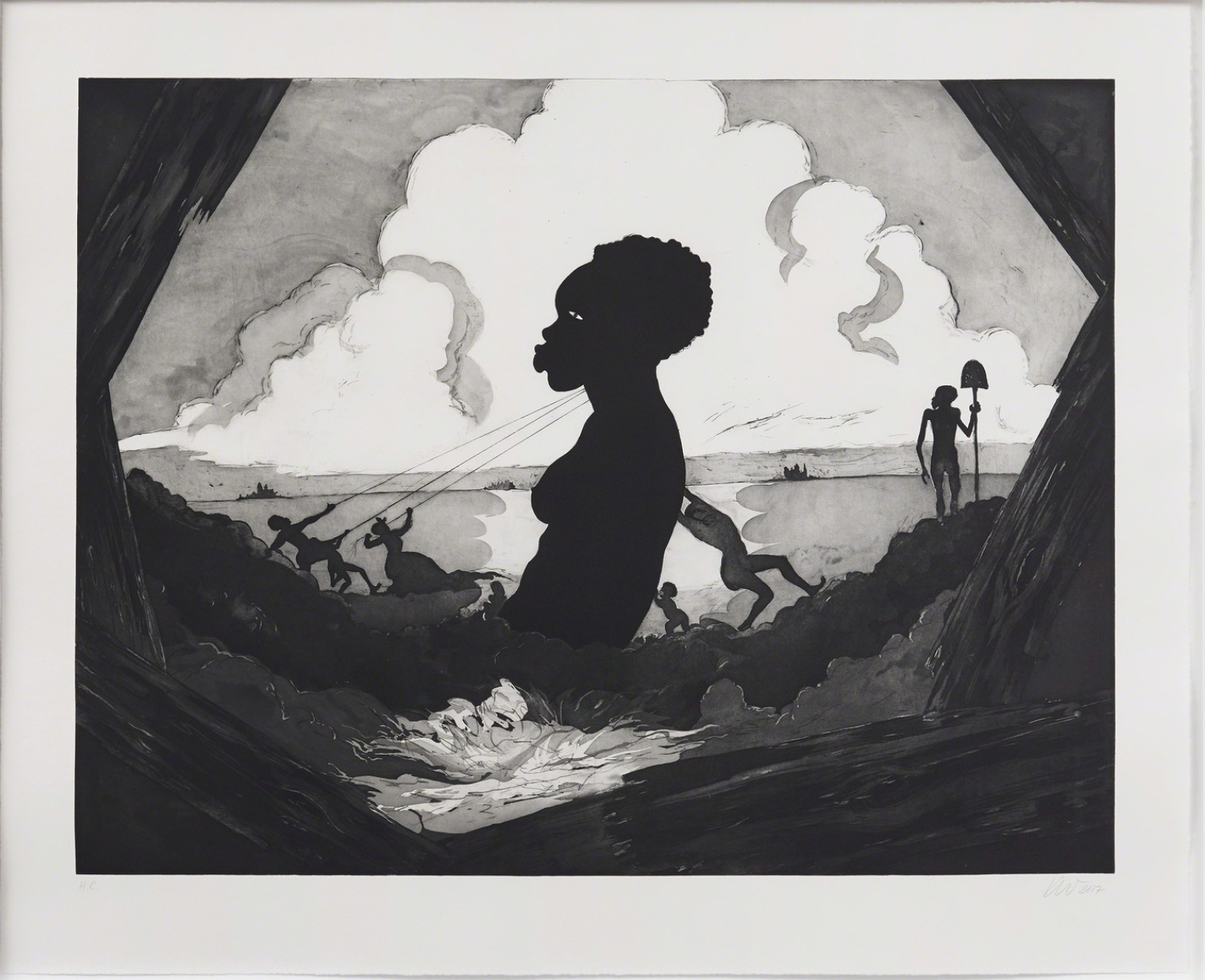

One such collector is Grażyna Kulczyck, a Polish billionaire behind the Museum Susch. She said in an interview with Artsy that she had acquired just as much last year as she did in 2019, in particular a work by Kara Walker. "The practice of collecting itself—traveling to attend art fairs and exhibitions around the world—has been impacted by the pandemic, but the quantity of my acquisitions has been relatively equal in 2020 compared to recent years."