Meet The Carbon Killers

A handful of carbon-reduction companies have set up pilot plants to suck carbon dioxide directly from the air to help meet climate goals. Will anyone give them money to succeed?

To keep global warming under 2˚C — the de facto target for global climate policy — it will take more than electric vehicles and wind turbines.

Scientists reckon that on top of energy-efficiency measures, around 10 billion tons of carbon dioxide needs to be removed from the atmosphere every year in the second half of the century.

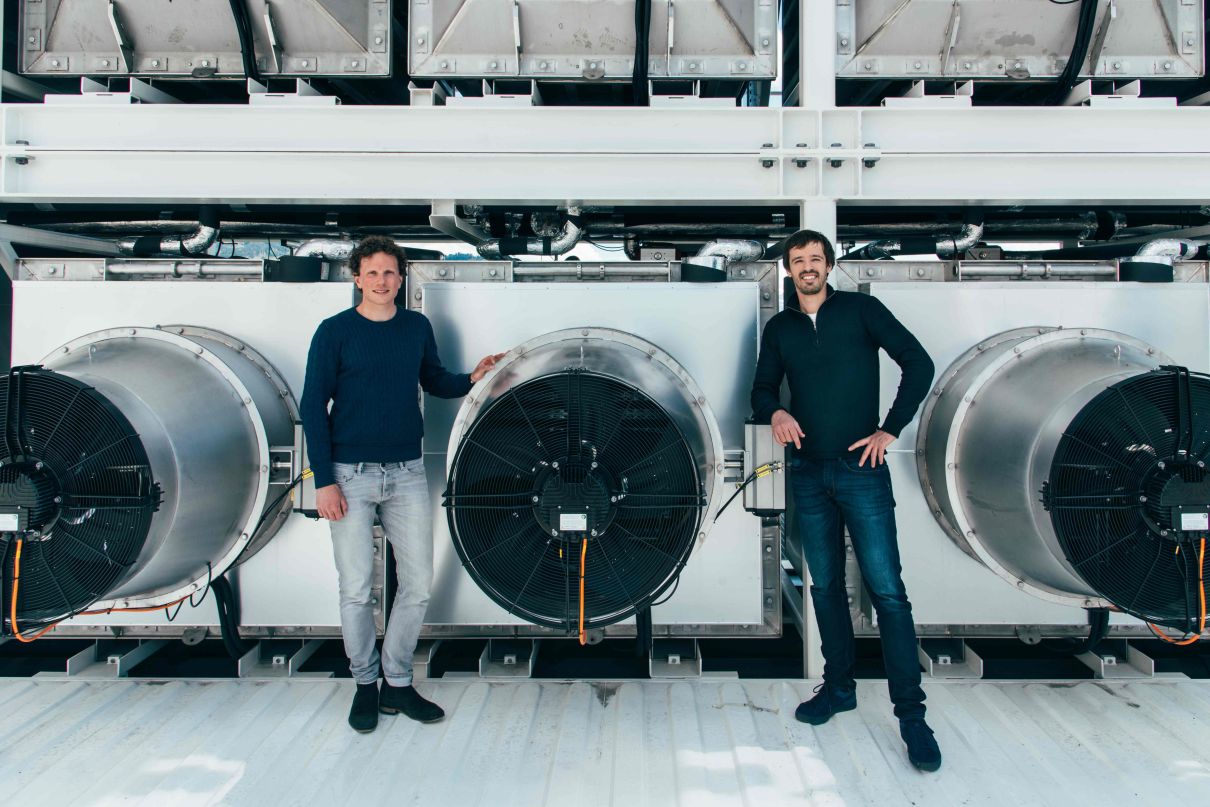

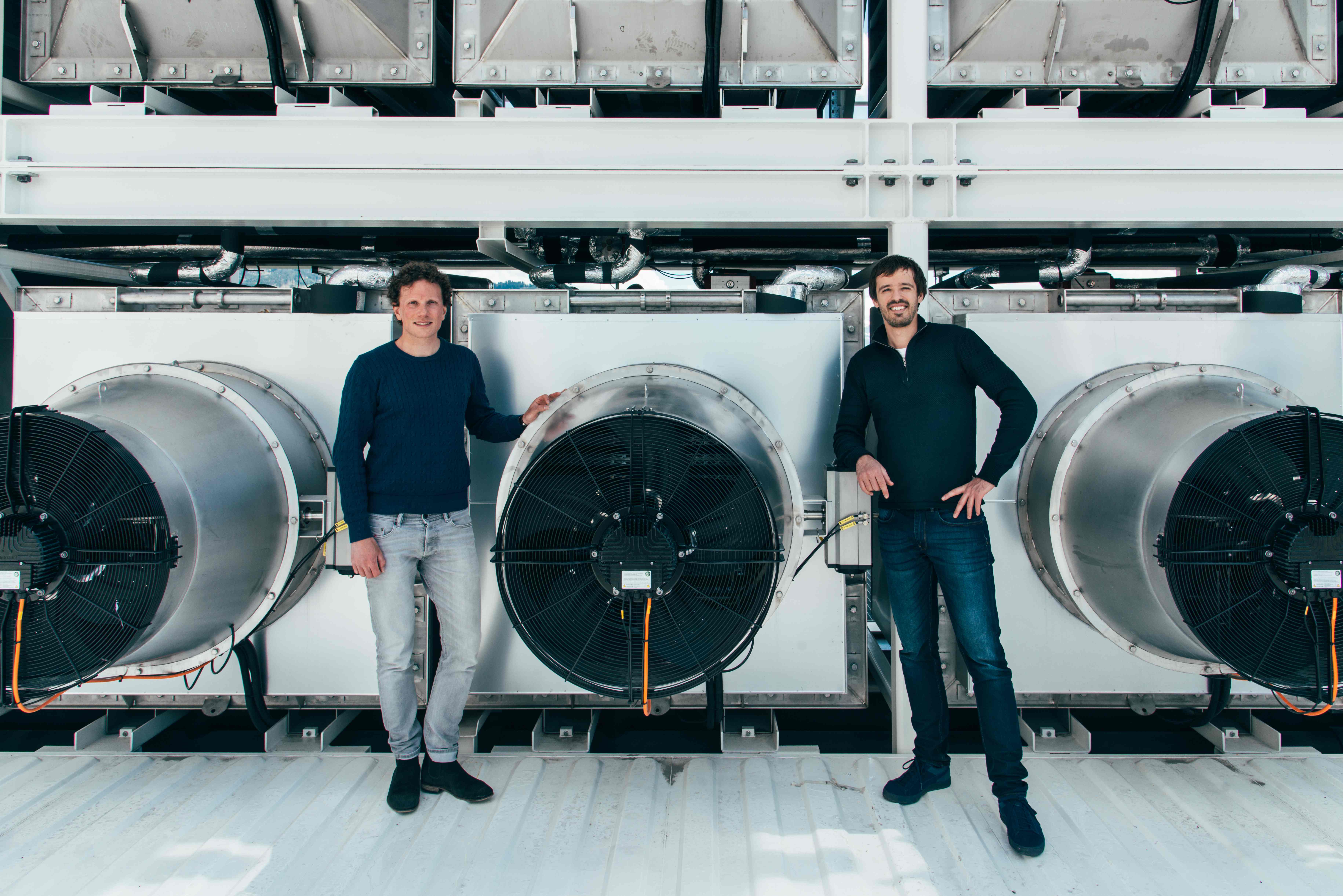

It’s an ambitious target but an achievable one, according to a handful of direct air capture (DAC) companies that have sprung up in the last decade. One such is Climeworks, a company based near Zurich that sucks carbon directly from the atmosphere and filters out pure CO2 to make a commercial product. Customers range from bars and restaurants using carrier gas for draft beers and soft drinks, to farmers who use CO2 inside greenhouses to boost crop yield.

The science behind Climeworks' approach works like this; ambient air is sucked into a plant, which reacts with a chemical solution to bind to its filter. Once the filter is saturated with CO2 it is heated to 100˚C, after which it re-emits pure carbon dioxide, which it sells to merchants. Climeworks is also experimenting with another approach: injecting CO2 into basaltic rock 700m beneath Iceland. When the CO2 reacts with the bedrock it forms solid minerals, creating a safe and permanent storage solution within a few hours. Climeworks proposes to sell this in exchange for carbon credits to companies that cannot avoid a carbon footprint.

So far, the company’s achievements have been small scale. DAC companies only produce a few tons of carbon a day, rather than the few million tons that are required. But Climeworks has “ambitious plans”, according to marketing manager Valentin Gutknecht.

“When we’re happy with the pilot we will scale up the plant to produce up to 3,000 tones of CO2 per year, within the next one to two years,” he says.

“The only way that’s left for the planet to achieve our climate targets is to do all and everything,” Gutknecht adds. “We will have to use traditional carbon-mitigation methods such as electric cars, solar energy, energy efficiency, to achieve carbon neutrality, but that’s just not going to be enough. On top of that we have to remove CO2 from the atmosphere to limit global warming to safe levels.”

On the face of it, direct air capture makes sense. To achieve the equivalent amount of carbon removal necessary through reforestation would require 6.4 million square kilometres of newly planted trees, not to mention the time it would take them to grow. However, direct air capture is about four times more expensive than reforestation. Climeworks has a target cost of US$100 per ton of CO2, if processed on a large scale. To achieve its goals, the company needs serious investors. It is approaching high-net-worth investors and corporates who wish to reverse unavoidable CO2 emissions. Since President Donald Trump pulled out of the Paris Agreement, says Gutknecht, the unexpected positive effect is that more high-net-worth individuals are taking greater responsibility for the planet.

“The awareness created through [Trump’s] decision has a huge value as it has become increasingly clear that we cannot depend on governments to impose a regulatory framework to stop global warming. It’s up to the economy and privates to tackle the challenge,” he says. Bill Gates, Jeff Bezos, Richard Branson and Michael Bloomberg are a few names who have poured funds into green energy in recent months.

Gutknecht adds that his industry is hoping for a time when the world’s governments implement a mandatory carbon tax to finance large-scale projects like the one at hand.

“The challenge is enormous,” he continues. “It will be a portfolio of companies and organisations that will solve this, but, for our part, we have a goal of removing 1 percent of global CO2 emissions — or 300 million tonnes per year — before the year 2025. That would be a significant contribution.”

There are a handful of others who form the cornerstones of the DAC industry, such as Carbon Engineering, a Canadian company with a pilot plant in Squamish, British Columbia, Canada. Set up in 2009 by Harvard physicist David Keith and funded in part by billionaires Bill Gates and Murray Edwards, it proves CO2 can be captured in industrial quantities and, combined with hydrogen, turned into fuel to power cars, trucks and aircraft, which account for a large chunk of global CO2.

The company’s objective is to produce a carbon-neutral alternative for the heavy transportation sector, which is unlikely to ever be able to rely on electricity. It currently captures 1 tonne of CO2 daily. If scaled up, it could capture millions of tonnes per year, and play a major role in shifting away from fossil fuels to meet climate goals. “Could we meet the Paris Targets? Technically, yes," says Geoff Holmes, development manager at Carbon Engineering. "There are no fundamental limits to building direct carbon capture plants. But economically or socially, that's probably not what we want to do."

He explains the abatement cost curve, that at the start, cutting emissions can save money, or at least come for free. "But as we cut emissions progressively out of the economy, it comes at higher and higher prices. So direct air capture coupled with underground injection, can compensate for emissions which are too challenging or costly to remove at source."

"We try to avoid grandiose hype that direct air capture is a solution to do it all. In reality we need a super aggressive mixture of emissions mitigations and negative emissions as well."

New York-based Global Thermostat takes a slightly different approach, with the ability to integrate its plants onto smoke stacks and power plants, either via retrofitting or new build. Like its Canadian peer, the management has pedigree, backed by billionaire former Warner Music Group CEO Edgar Bronfman Jr and co-founded by economist Graciela Chichilnisky, who helped devise the carbon market of the 1997 Kyoto Protocol.

There is a reason why, for now, only a few hundred people work in this all-important industry. Capturing carbon directly from the air is not an easy task. Although the amount of carbon in the air is harmful to the planet, the amount of CO2 molecules in the air is tiny. To scale up needs more investment and to get venture capital funding for such a project is almost impossible, points out Gutknecht, as the process is long term; anathema to investors seeking a fast flip.

One alternative is getting paid through carbon credits, which are becoming a fast-growing tradeable commodity with a few stock exchanges trading in carbon allowances, including NASDAQ. The market was estimated to be worth about €56 billion in 2012 (although this is small when, for example, compared to the + €1 trillion luxury goods market). China, which now emits about 30 percent of global emissions, has made a voluntary pledge to lower CO2 per unit of GDP by 40 to 45 percent in 2020. The country could prove to be a valuable customer for direct air capture companies. There's also California's Low Carbon Fuel Standard, brought in a decade ago, which allows low carbon fuels to generate high value credits.

"In principle, performance-based carbon markets, a well-design carbon tax, a cap-and-trade allowance system, further regulation, could all do the trick to finance this," says Holmes. "But cutting emissions is an immense, systemic, industrial problem. Ultimately it will come down to good governments and good policy to create conditions that entrepreneurs and individuals can go out and act upon."

The acid test will be the backing of governments and corporates for such innovations, or to implement a steel-edged carbon tax, without which, the Paris goals are unlikely to be met. And, by then, time really will be running out.

This article originally appeared in Billionaire's Ideas issue, March 2018. To subscribe contact