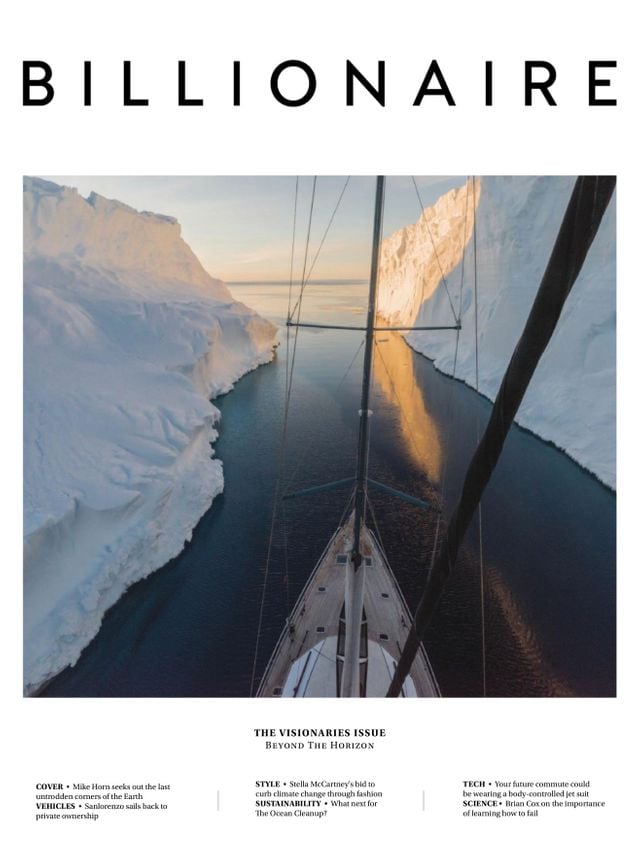

A Change of Tack

Massimo Perotti is relishing superyacht company Sanlorenzo being bought back to 100 percent Italian ownership.

It is, I sense, a busy week for Massimo Perotti, chairman and chief executive of Italian superyacht company Sanlorenzo. He arrives 45 minutes late to our interview in the Collectors’ Lounge at Art Basel Hong Kong, and answers two phone calls during our conversation.

Perotti is a man who likes to work to his own schedule. And yet it’s an approach that seems to have paid off. As the company nears its 15th year under his helm, revenues have soared from €42 million when he acquired it in 2004, to €380 million last year.

He expects to add another €80 million this year and, somehow, I don’t doubt it.

Perotti made recent headlines when — in a show of great confidence — he bought back a combined 39 percent holding from the group’s two major investors: 16 percent from Fondo Italiano d’Investimento bought back in 2010; and 23 percent from China’s Sundiro Holding, bought in 2013.

Now, he says with relish, the group has returned to 100 percent Italian ownership; specifically, 96 percent is held through the holding company he co-owns with his son and daughter, with the remaining 4 percent in the hands of Sanlorenzo management. Perotti is clearly delighted.

“The story of me buying back from the Chinese was like the owner that bites the dog, instead of the dog that bites the owner,” he chuckles.

Perotti’s reasoning for the buyback was simple politics, he says candidly. “I am 58 years old, and, God willing, have another 15 years to go. I have a lot of energy and ideas and I want to develop those ideas without having partners who do not really understand and do not have the vision I have. So, the reason is to be free for the further development of the company.”

He does not believe that China is poised to become a superyachting Mecca, at least not for a while. For Sanlorenzo to distance itself from what was once a China goldrush is symptomatic of the market at large. Superyacht sales in the region have been fettered by the 45 percent luxury tax and the anti-corruption drive. Even for those yachts delivered outside China into Hong Kong, there is a dire shortage of berths, says Mike Simpson, founder of Simpson Marine, a yacht sales, charter and management company that represents Sanlorenzo. “Although there is growing interest in South East Asia, overall, the region is still a relatively small market,” he adds.

Still, for a company selling superyachts from around €4 million (that’s for the smallest 24m SX76, minus the fit out) up to €50 million, all it takes is one or two buyers. Sanlorenzo recently signed a contract for a 52m yacht and has a 44m yacht in build, both to South East Asians.

Perotti cut his teeth at rival Azimut-Benetti. He started there at the age of 22, working his way up to general director by 44, growing the business from a staff of 25 to an industry megalith of 3,000 employees and a turnover of around €700 million.

When the opportunity to buy Sanlorenzo arose in 2004, he jumped at the chance, as he puts it “to inject his experience and connections into the brand”. He puts its subsequent success down to expanding the products into four different lines ranging from the smallest fibre-glass-hulled SX Line (24-36m) to metal-hulled superyachts of up to 64m. He grew the brand beyond the Mediterranean into the US and Asia, which now make up a combined 30 percent of revenues. But, most importantly, he brought the made-to-measure approach to the whole stable — not just the biggest yachts.

“Owners have the possibility to change the décor and the layout completely, which, on the smaller yachts, doesn’t exist in any other company,” says Perotti.

Sergio Buttiglieri, Sanlorenzo style director, describes accompanying owners around design fairs such as Salone del Mobile in Milan to inform their individual aesthetic. Together, they cherry-pick through Eames lounge chairs, Marcel Breuer desks, classic lamps by Gino Sarfatti and other tasteful pieces. Afterwards, he will treat them to an opera at La Scala to celebrate a good day’s shopping. A team of architects will start with a blank canvas and hone the interior fit-out with the client, and the sky is the limit: stained-oak floorings, marble bathrooms, sumptuous leathers and velvet furnishings.

Naturally, all of this translates into higher costs and a long production time. Owners can expect up to a two-year wait. For some, it is worth it, in order to own a unique creation as opposed to a product off the shelf.

“When you have two or three Sanlorenzos in a marina, the owners want to meet the other owners so they can take a look inside each other’s yachts,” Perotti says. “You wouldn’t get that with another yacht because they are all the same. Okay, you can change the colour of the carpet or curtains, but for a yacht below 40m, essentially, it is all the same.”

Perotti’s personal style reflects that which he has injected into the business. Tall, tanned and youthful for his 58 years, he is relaxed in a tailored navy suit and a classic watch. (“Only Patek Philippe”, he emphasises.) At home, he drives a 1958 two-seater roadster, a Mercedes ‘Pagoda’. He lives in the Cinque Terre, Italy’s legendary Riviera, a short and lovely commute from the superyacht production yard in La Spezia. When he has time for a holiday, which is rare, he skies in the Alps with his family, who along with his business, are the great love of his life.

Perotti adores art, with a personal collection including post-war Italian masters Alighiero Boetti, Alberto Burri and Paolo Scheggi. Last year, he signed a global sponsorship with Art Basel as the main superyacht partner to exhibit in Miami, Hong Kong and Basel. As we chat in Art Basel Hong Kong’s Collectors’ Lounge, he points out the installation designed by art director Piero Lissoni in homage to the French born-Chinese artist Alixe Fu, a nod to Sanlorenzo’s creative affinity.

We move on to discussing the future. Unfettered by shareholders, Perotti recently bought a stake in a sporty powerboat company called Bluegame and has plans for another acquisition. The aim is to keep growing revenues by another €150 million or so. I suggest we could be entering another difficult phase for the luxury industry given current socio-political turbulence. Perotti shrugs. “We don’t think there will be a third world war. Yes, there’s economic discussion. Brexit? I don’t believe the UK will leave the EU. China and the US won’t break as it is against both of their interests. I think it’s all a lot of talk and the market will stay good.”

There is something about his unwavering self-confidence that makes it almost impossible to doubt. Still, only time can tell what the winds will bring.

This article originally appeared in Billionaire's Visionaries Issue, March 2019. To subscribe, contacts